Introduction

Pensacola, located on Florida’s Gulf Coast, is known for its white-sand beaches, naval history, and a vibrant downtown scene. It attracts a wide range of tourists, from families and beach lovers to history buffs. This coastal city is ideal for short-term rental investments, and understanding the top-performing zip codes can help maximize your returns. Here’s a detailed analysis of each area based on gross yields, annual revenues, Zillow home values, and local insights.

32505: Brownsville & West Pensacola

- Gross Yield: 14%

- Annual Revenue: $19,711

- Zillow Home Value: $141.7K

Zip code 32505 encompasses neighborhoods like Brownsville and parts of West Pensacola, areas that are more affordable but yield a high return on investment. With a gross yield of 14%, it stands out as the top performer in terms of rental income potential. The annual revenue of $19,711, combined with a low Zillow home value of $141.7K, makes it a budget-friendly option for investors. This area is seeing growth and redevelopment efforts, attracting a steady stream of renters looking for cost-effective accommodations close to downtown and the beach.

32504: Scenic Heights & Ferry Pass

- Gross Yield: 9%

- Annual Revenue: $24,394

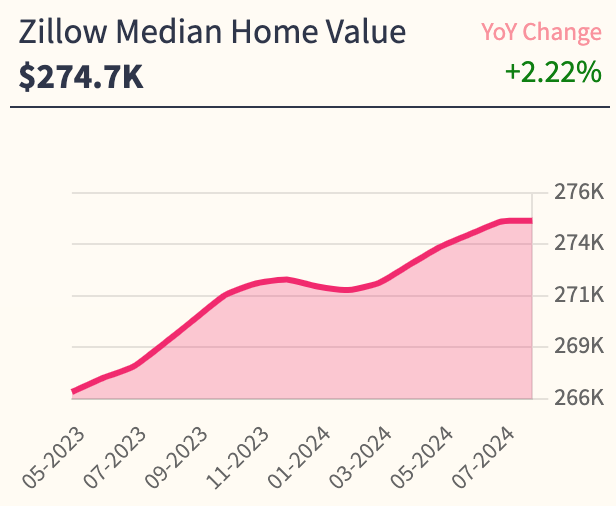

- Zillow Home Value: $274.7K

This zip code covers neighborhoods like Scenic Heights and Ferry Pass, which are popular residential areas with a mix of older and newer homes. It offers a gross yield of 9% and annual revenue of $24,394, which is a solid performance for investors. The home value of $274.2K reflects a more established market, and the proximity to shopping, dining, and the University of West Florida adds to the rental appeal. Families and professionals are often drawn to this area for its suburban feel and convenient amenities.

32503: East Hill & Cordova Park

- Gross Yield: 9%

- Annual Revenue: $24,611

- Zillow Home Value: $285.6K

Zip code 32503 is home to the trendy East Hill and Cordova Park neighborhoods, which are known for their charming tree-lined streets and historic homes. With a gross yield of 9% and annual revenue of $24,611, this area attracts tourists looking for a blend of history and modern amenities. Zillow home values average $285.6K, reflecting the desirability of these well-maintained, vibrant communities. East Hill, in particular, is known for its parks and walkability, making it a popular choice for vacation rentals.

Top 100 Airbnb Rental Markets

Instantly compare the top 100 short-term (Airbnb) rental markets in the US

32501: Downtown Pensacola

- Gross Yield: 9%

- Annual Revenue: $21,838

- Zillow Home Value: $256.4K

Zip code 32501 covers the bustling heart of downtown Pensacola, an area teeming with restaurants, shops, and entertainment venues. It has a gross yield of 9% and annual revenue of $21,838, making it a dependable investment area. With Zillow home values at $256.4K, properties here are more affordable compared to nearby beach areas but still provide strong rental income. The downtown area’s rich history and cultural attractions keep visitors coming year-round, ensuring a healthy demand for short-term rentals.

32502: Pensacola Beach & Waterfront Areas

- Gross Yield: 8%

- Annual Revenue: $27,846

- Zillow Home Value: $330.3K

This zip code includes Pensacola Beach and other waterfront areas, making it a prime location for vacationers. Despite having a lower gross yield of 8%, the annual revenue of $27,846 is the highest among the listed zip codes, thanks to the area’s premium rental rates. With Zillow home values at $330.3K, investing here requires a higher initial investment, but the breathtaking views and proximity to the beach guarantee consistent bookings and high occupancy rates. It’s an excellent choice for investors looking to cater to tourists seeking the ultimate beach experience.

Conclusion

These Pensacola zip codes present a variety of opportunities for short-term rental investors, from budget-friendly areas with high yields to premium beachside properties. By leveraging the city’s strong tourism market, investors can tap into both high returns and property appreciation over time.