Written by: Ashley Durmo

Introduction

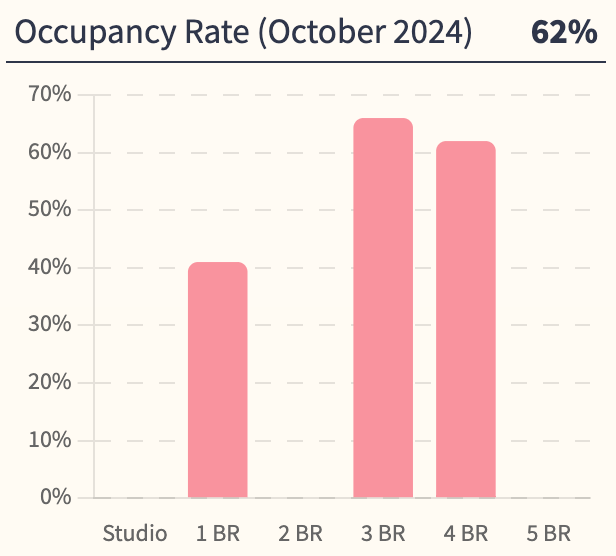

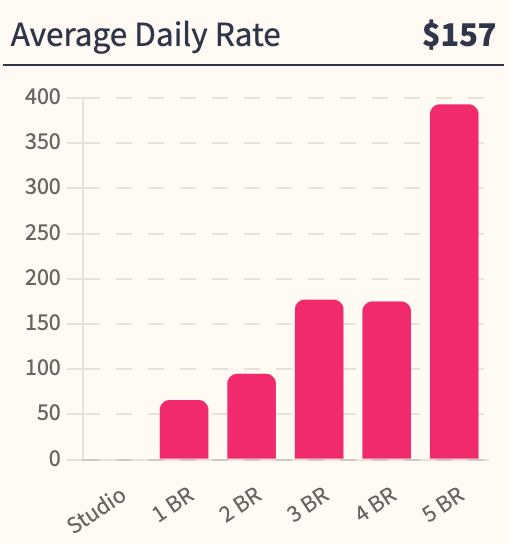

Houston’s real estate market offers diverse opportunities for short-term rental investors. In this guide, we’ll highlight some of the top-performing ZIP codes, showcasing data on gross yield, annual revenue, and home values, combined with insights about the neighborhoods.

77049 – Northshore/Baytown Area

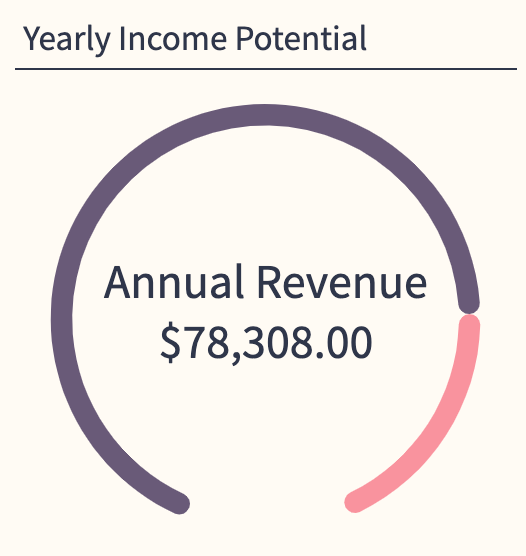

- Gross Yield: 31%

- Annual Revenue: $78,308

- Zillow Home Value: $248.9K

ZIP code 77049 is located in the Northshore and Baytown area, close to major transportation routes like Interstate 10 and the Sam Houston Tollway. This region features a mix of suburban communities, parks, and a robust industrial presence, making it attractive for short-term rentals targeting traveling professionals and families. The high gross yield of 31% and solid annual revenue indicate strong rental demand in this area, possibly due to its strategic location near the Port of Houston and easy access to downtown.

77026 – Fifth Ward

- Gross Yield: 14%

- Annual Revenue: $20,129

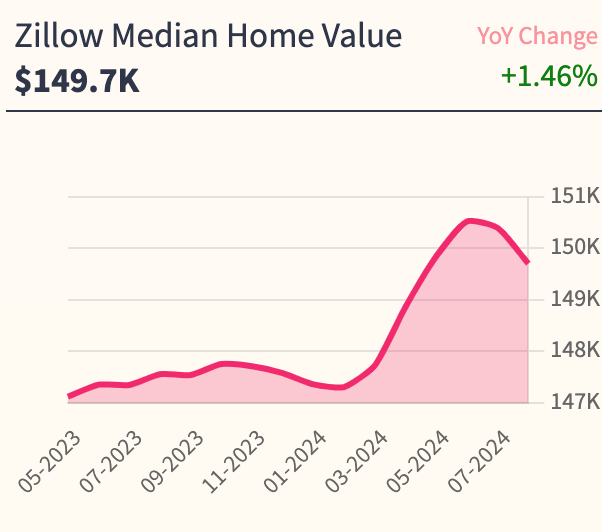

- Zillow Home Value: $149.7K

The 77026 ZIP code encompasses the historic Fifth Ward neighborhood, an area known for its rich cultural heritage and proximity to downtown Houston. Despite having a lower gross yield of 14%, the affordable Zillow home value of $148.1K makes entry into this market more accessible for investors. With ongoing revitalization efforts and potential for future growth, investing in this area could be a strategic long-term play, particularly for those targeting travelers interested in exploring Houston’s rich African-American history and vibrant arts scene.

77086 – Greater Inwood

- Gross Yield: 13%

- Annual Revenue: $29,692

- Zillow Home Value: $226.0K

ZIP code 77086 covers the Greater Inwood area, a suburban neighborhood known for its green spaces, like the White Oak Bayou Greenway, and its family-friendly vibe. With a gross yield of 13% and a reasonable annual revenue of $29,692, this area offers a balance between affordability and potential rental income. The neighborhood attracts both tourists and business travelers looking for a quieter stay while being well-connected to Houston’s bustling downtown and surrounding commercial hubs.

Top 100 Airbnb Rental Markets

Instantly compare the top 100 short-term (Airbnb) rental markets in the US

77020 – Denver Harbor/Port Houston

- Gross Yield: 13%

- Annual Revenue: $22,678

- Zillow Home Value: $173.5K

Denver Harbor and Port Houston, part of ZIP code 77020, have seen significant redevelopment in recent years. The area is known for its proximity to the East River Project and new amenities along Buffalo Bayou. Though the gross yield stands at 13%, the lower Zillow home value of $173.5K means initial investment costs are relatively low. This area is an appealing option for investors interested in urban redevelopment, especially as new businesses and amenities continue to transform the neighborhood.

77035 – Westbury/Willowbend

- Gross Yield: 13%

- Annual Revenue: $33,898

- Zillow Home Value: $267.1K

Located in the southwest part of Houston, the 77035 ZIP code includes neighborhoods like Westbury and Willowbend. These communities are known for their large lots, family-oriented atmosphere, and proximity to the Texas Medical Center, making them attractive to medical professionals and long-term tourists. The gross yield of 13% and an annual revenue of $33,898 suggest steady demand, while the relatively higher Zillow home value reflects the area’s strong property market. For investors, the appeal lies in the consistent rental income generated by the area’s stable, desirable demographics.

Conclusion

Houston offers a variety of short-term rental investment opportunities across its diverse neighborhoods. Whether you are interested in high yields, affordable entry points, or proximity to major attractions, the city’s submarkets present a compelling case for investors.