Welcome to our March 2025 short-term rental market update. This report provides insights based on an analysis of our top 100 short-term rental markets, using various metrics to highlight the biggest trends and opportunities for investors. Our methodology focuses on year-over-year changes in home values, rental yields, net revenues (net of cleaning fees), unemployment rate changes, and investor interest based on our platform data.

The short-term rental market continues to evolve in March 2025, showcasing dynamic shifts in home values, rental yields, and investor interests. Let’s dive into key insights that might help you make informed investment decisions this month.

Home Values on the Rise

This year has been favorable for many property owners, with 65.5% of markets experiencing an increase in home values year-over-year.

Among the leading markets, Cleveland stood out with a massive 10.79% increase in home value, followed closely by Detroit (9.51%) and Carlsbad (9.47%).

If you’re considering investing, these markets are seeing strong property appreciation, which might be a promising sign for future value growth.

Here are the top 10 markets for home value increase:

| Rank | Market | Year-Over-Year Change (%) |

|---|---|---|

| 1 | Cleveland | 10.79 |

| 2 | Detroit | 9.51 |

| 3 | Carlsbad | 9.47 |

| 4 | San Diego | 8.65 |

| 5 | Oceanside | 8.16 |

| 6 | Charleston | 7.97 |

| 7 | Augusta | 7.65 |

| 8 | Miami | 7.52 |

| 9 | Buffalo | 7.27 |

| 10 | South Bend | 6.85 |

Home Value Declines

While many markets saw growth, some experienced a decline in home values. Among the markets with the largest year-over-year declines, Broken Bow saw a -8.44% decrease, followed by Bradenton Beach (-8.04%) and New Orleans (-6.97%).

Here are the top 5 markets with the largest decline in home values:

| Rank | Market | Year-Over-Year Change (%) |

| 1 | Broken Bow | -8.44 |

| 2 | Bradenton Beach | -8.04 |

| 3 | New Orleans | -6.97 |

| 4 | Gatlinburg | -6.29 |

| 5 | Destin | -6.15 |

Markets with Impressive Gross Yields

Gross yields are a crucial indicator for investors aiming to maximize returns, and Detroit leads the way with a 30.88% gross yield.

This is followed by Cleveland (21.47%) and Memphis (20.23%), all offering attractive returns for rental property owners.

Whether you’re a seasoned investor or just starting out, these locations provide some of the highest potential returns in the short-term rental space.

Here are the top 10 markets for gross yields:

| Rank | Market | Gross Yield (%) |

| 1 | Detroit | 30.88 |

| 3 | Cleveland | 21.47 |

| 4 | Memphis | 20.23 |

| 5 | Baltimore | 19.89 |

| 6 | St. Louis | 19.50 |

| 7 | Cincinnati | 18.75 |

| 8 | Pittsburgh | 18.42 |

| 9 | Buffalo | 17.90 |

| 10 | Milwaukee | 17.56 |

Top 100 Airbnb Rental Markets

Instantly compare the top 100 short-term (Airbnb) rental markets in the US

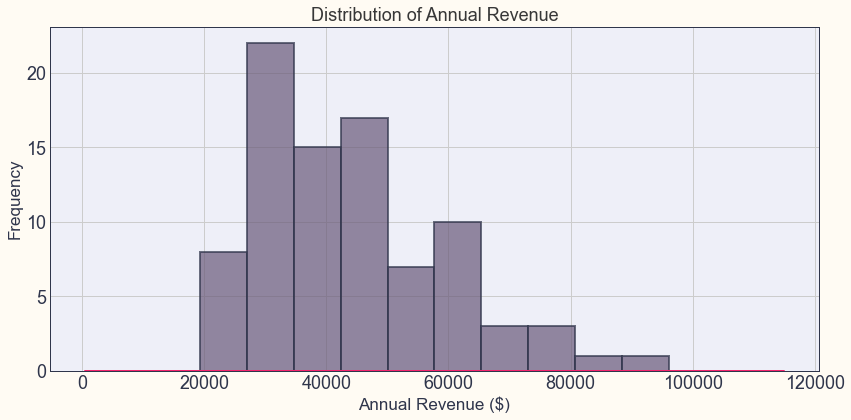

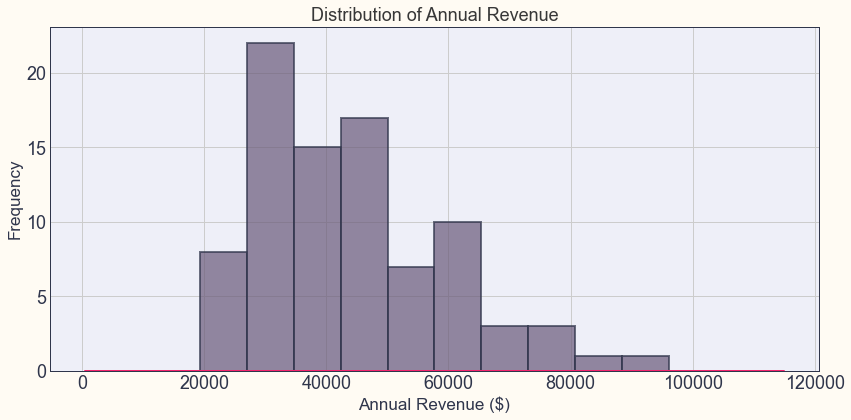

Top Markets by Annual Net Revenue

Revenue potential is a key factor in choosing a market.

For October, Key West led with an annual net revenue of $85,400, followed by Encinitas ($83,250) and Palm Springs ($81,900).

These figures are net of cleaning fees, providing a more accurate representation of the income investors can expect.

Here are the top 10 markets by annual net revenue:

| Rank | Market | Annual Net Revenue |

| 1 | Key West | $96.103 |

| 2 | Encinitas | $83,390 |

| 3 | Palm Springs | $77,311 |

| 4 | Charleston | $76,358 |

| 5 | Carlsbad | $73,952 |

| 6 | Vail | $70,052 |

| 7 | Sedona | $69,539 |

| 8 | Oceanside | $66,702 |

| 9 | Indian Rocks Beach | $62,705 |

| 10 | Gatlinburg | $61,961 |

Unemployment Rate Changes

Unemployment rates can significantly impact rental markets. Some areas experienced a rise in unemployment, while others saw improvement. Detroit had the largest year-over-year increase in unemployment rate at 1.2%, followed by Yucca Valley (1.1%) and Orlando (0.9%). Conversely, Austin saw a decrease in unemployment by -0.8%, followed by Boise (-0.7%) and Denver (-0.6%).

Here are the top 5 markets with the largest increase in unemployment rate:

| Rank | Market | Unemployment Rate Change (%) |

| 1 | Detroit | 1.2 |

| 2 | Yucca Valley | 1.1 |

| 3 | Orlando | 0.9 |

| 4 | Phoenix | 0.8 |

| 5 | Tampa | 0.7 |

Here are the top 5 markets with the largest decrease in unemployment rate:

| Rank | Market | Unemployment Rate Change (%) |

| 1 | Austin | -0.8 |

| 2 | Boise | -0.7 |

| 3 | Denver | -0.6 |

| 4 | Charleston | -0.5 |

| 5 | Nashville | -0.4 |

Investor Favorites: Chalet’s Top Markets

When it comes to investor interest, our Chalet platform data shows that Gatlinburg led the way, accounting for 4.2% of total investor traffic. Other highly popular markets among investors include Cape Coral-Fort Myers (4.1%), Myrtle Beach (3.7%), and Joshua Tree (3.3%). If you’re seeking to follow the crowd or identify high-interest areas, these markets are clearly on the radar of many savvy investors.

Here are the top 10 markets by investor interest:

| Rank | Market | Percentage of Total Traffic (%) |

| 1 | Gatlinburg | 4.20 |

| 2 | Cape Coral-Fort Myers | 4.11 |

| 3 | Myrtle Beach | 3.71 |

| 4 | Joshua Tree | 3.28 |

| 5 | Big Bear | 3.07 |

| 6 | Houston | 3.04 |

| 7 | Pensacola | 2.89 |

| 8 | Kissimmee | 2.58 |

| 9 | Broward County | 2.54 |

| 10 | Cleveland | 2.11 |

What’s Next for Investors?

October has been a month of growth and opportunity, with several markets standing out for their appreciation in value, yield potential, and investor attention. Whether you’re interested in appreciation potential, rental yields, or investor hotspots, there’s a wealth of data to help guide your decisions this month.

Stay ahead of the curve by monitoring these trends, and feel free to explore our dashboard for more detailed analytics on short-term rental markets!