Introduction

Kansas City, Missouri, has become a popular destination for short-term (Airbnb) rentals in recent years. The city’s affordability, unique attractions, and investor-friendly regulations have made it an attractive location for property owners looking to enter the short-term rental market. In this blog post, we’ll take a closer look at the short-term rental market in Kansas City, MO, using data points provided by Chalet, Zillow, and SmartAsset.

Market Overview

To understand the dynamics of the short-term rental market in Kansas City, let’s delve into some key statistics and figures.

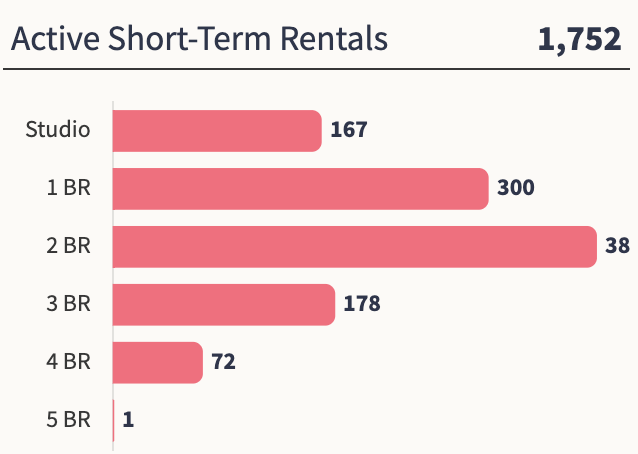

Supply

AS of July 2025, the most popular homes are 2-bedroom homes, comprising 26.36% of inventory. This is followed by 1 and 3-bedroom homes at 20.60% and 20.32% of the total inventory, respectively.

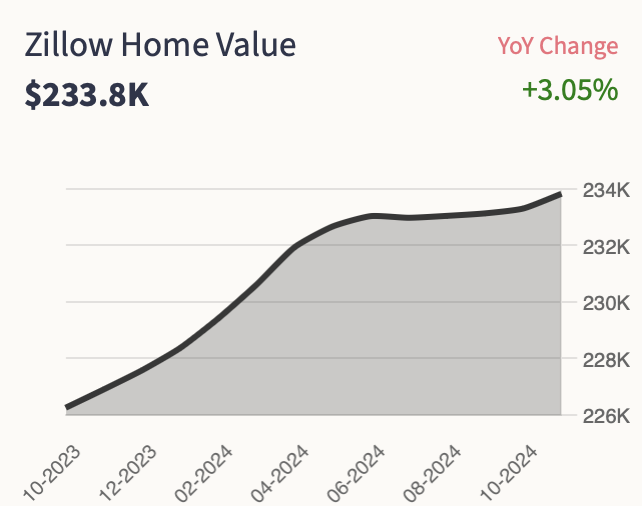

Homes Appreciation

AS of July 2025, according to Zillow, homes in Kansas City experienced an appreciation of 3.05%. This data indicates a significant increase in property values.

Median Home Value

As of January of 2025, Homes in Kansas City have appreciated by 3.05%. The median home value in Kansas City is $233,800 as reported by Zillow. This figure highlights the city’s robust real estate market and the potential for long-term property appreciation.

Active Short Term Rentals

AS of July 2025, Kansas City boasts a significant Airbnb rental market, with approximately 1,752 active rentals. This abundance of available properties provides ample opportunities for investors and homeowners looking to capitalize on the tourism demand.

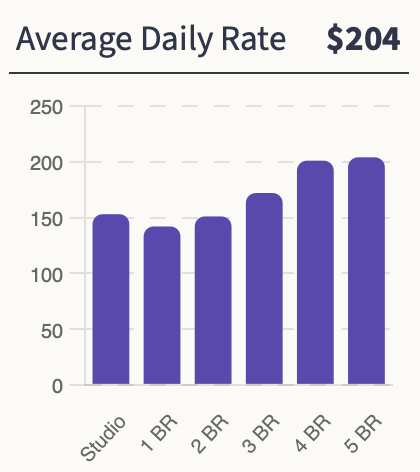

Average Daily Rate

The median ADR for the market is $204. The Average Daily Rate is the highest for 5-bedroom homes $204, followed by 4-bedrooms and 3 bedrooms at $201 and $172 respectively.

Occupancy Rate

Chalet data reveals an occupancy rate of 58.23% for Airbnb rentals in Kansas City. This high demand ensures a consistent stream of income for property owners and investors.

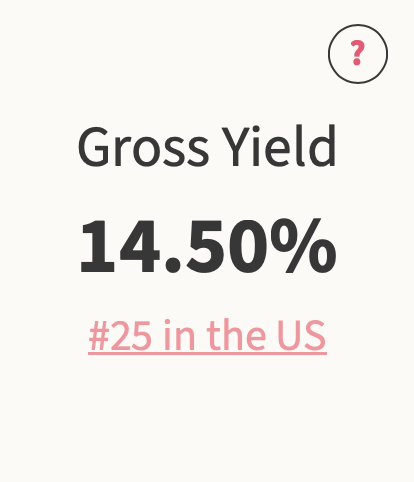

How Profitable is Airbnb in Kansas City ?

AS of July 2025, the average gross yield, which represents the annual income generated by a property as a percentage of its value, is 14.50% in Kansas City. This figure suggests that short-term rentals in the city offer a favorable return on investment. Kansas City is ranked #15 by return on investment on Airbnb rentals in the United States.

Annual Revenue

According to Chalet, short-term rentals in Kansas City earn an average of $25,257 annually, highlighting the strong investment potential in the city’s market. You can evaluate your properties using our free Airbnb calculator.

Top Places for Airbnb in Kansas City

Kansas City’s top submarkets for Airbnb investments include areas like ZIP code 64123, which has the highest gross yield at 31% and an annual revenue of $39,564. In contrast, ZIP code 64105 offers more extensive opportunities with 171 full-time listings, but a lower gross yield of 19%.

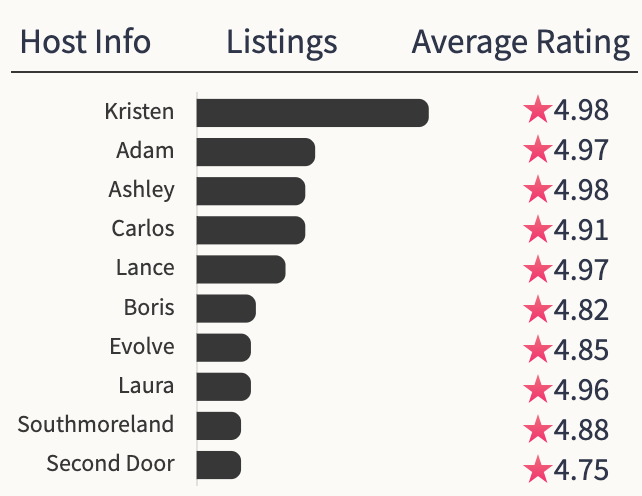

Hosts

The market is not dominated by property management firms. The largest host is Kristen with 4.98% of the total inventory and an average review of 4.77⭐️s .

Property Tax

According to SmartAsset, the average property tax in Kansas City is 1.28%. This relatively moderate tax rate is an important consideration for those looking to invest in short-term rental properties.

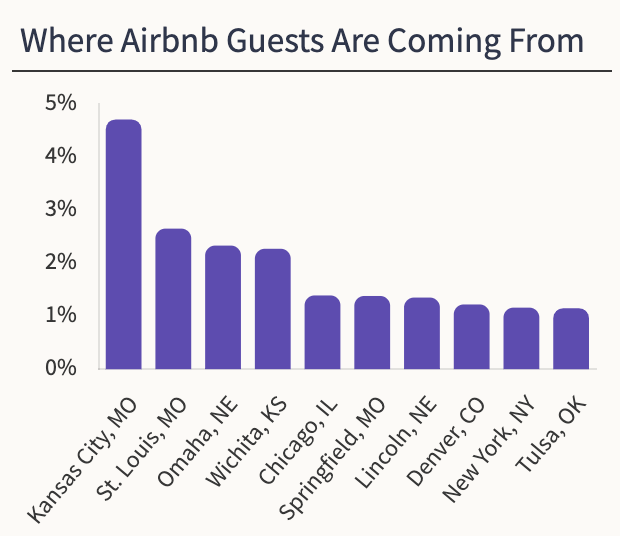

Guests

The majority of the guests in Kansas City come from Missouri and are within driving distance. 4.80% of all guests are from Kansas City followed by St.Louis with 2.50%.

Regulations

Kansas City short-term rental regulations are somewhat investor-friendly, with different zoning regulations and limitations in place. Understanding these regulations is crucial for potential investors to ensure compliance and a smooth operation.

Top 100 Airbnb Rental Markets

Instantly compare the top 100 short-term (Airbnb) rental markets in the US

Other facts

Kansas City, MO, is the largest city in the state of Missouri, with a population of over 500,000 people. Located in the western part of the state, Kansas City, MO, is a thriving cultural and economic hub, attracting visitors from all around the world.

Median Household Income: According to the US Census Bureau, the median household income in Kansas City, MO, is $59,940, which is higher than the national median of $62,843.

Climate: Kansas City, MO, has a humid continental climate with four distinct seasons. Summers are hot and humid, while winters are cold and snowy. Spring and fall are mild and comfortable.

Population Size: The population of Kansas City, MO, is estimated to be 500,000 people, making it the largest city in the state of Missouri.

Sports Teams: Kansas City, MO, is home to several professional sports teams, including the Kansas City Chiefs (NFL), the Kansas City Royals (MLB), and Sporting Kansas City (MLS).

Colleges: There are several colleges and universities located in Kansas City, MO, including the University of Missouri-Kansas City, Rockhurst University, and Avila University.

Crime Rate: According to NeighborhoodScout, the crime rate in Kansas City, MO, is higher than the national average, with a crime rate of 60 per 1,000 residents.

Visitors: Visitors to Kansas City, MO, come from all around the world, with the majority coming from the United States. According to Visit KC, the total number of visitors to Kansas City, MO, was 27.6 million in 2019.

Tourist Attractions: Kansas City, MO, is home to several popular tourist attractions, including the National World War I Museum and Memorial, the Kansas City Zoo, and the Nelson-Atkins Museum of Art.

Peak Season: The peak season in Kansas City, MO, is typically from May to September when the weather is warm and pleasant, and many outdoor events take place.

Regulatory Environment for Short-Term Rentals

Another important factor for Airbnb rental investors is the regulatory environment in the city. Fortunately, Kansas City, MO, is investor-friendly when it comes to short-term rentals. While there are regulations in place, they are not as strict as in other cities, allowing investors to operate their short-term rental properties with minimal interference.

Conclusion

In conclusion, the Airbnb rental market in Kansas City, MO, is experiencing healthy growth, with an increase in supply and healthy demand. The city’s affordable housing market, unique attractions, and investor-friendly regulations make it an attractive location for real estate investors. With an average gross yield of 14.40% and lower-than-average property taxes, Kansas City, MO, is an ideal location for investors looking to enter the short-term rental market.