Introduction

Detroit, Michigan, once known as the “Motor City,” has seen its housing market undergo significant changes in recent years. This blog post will delve into the short-term rental market in Detroit, focusing on both Airbnb and other short-term rental platforms. We’ll explore key data points, market trends, and factors that make Detroit an attractive destination for property investors in the short-term rental market.

Market Overview

To understand the dynamics of the short-term rental market in Minneapolis, let’s delve into some key statistics and figures.

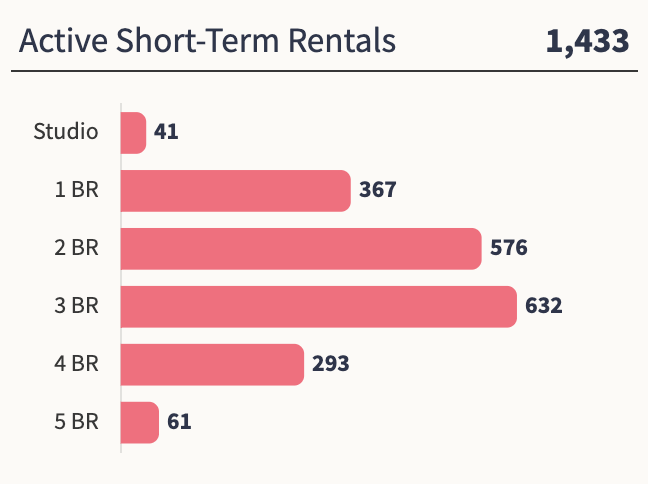

Supply

The most popular homes are 3-bedroom homes, comprising 46.82% of inventory. This is followed by 2-bedroom homes at 31.36% and 1-bedroom 13.64% of the total inventory, respectively.

Homes Appreciation

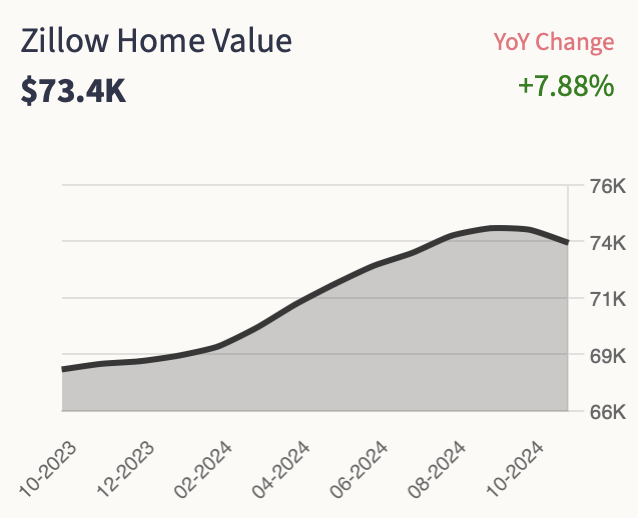

AS of July 2025, according to Zillow, homes in Detroit experienced an appreciation of 7.88%. This data indicates a significant increase in property values.

As of January of 2025, Homes in Detroit have appreciated by 7.88%. The median home value in Minneapolis is $73,400 as reported by Zillow. This figure highlights the city’s robust real estate market and the potential for long-term property appreciation.

Active Short Term Rentals

AS of July 2025, Detroit boasts a significant Airbnb rental market, with approximately 1,433 active rentals. This abundance of available properties provides ample opportunities for investors and homeowners looking to capitalize on the tourism demand.

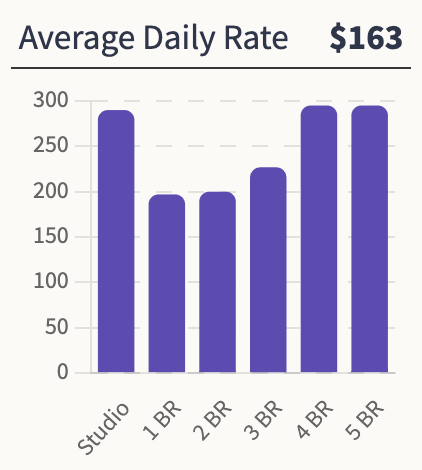

Average Daily Rate

The median ADR for the market is $162.47 The Average Daily Rate is the highest for 4 bedroom homes ($295) followed by 5 and studio bedrooms at $280 and $270 respectively.

Occupancy Rate

Chalet data reveals an occupancy rate of 53% for Airbnb rentals in Detroit. This high demand ensures a consistent stream of income for property owners and investors.

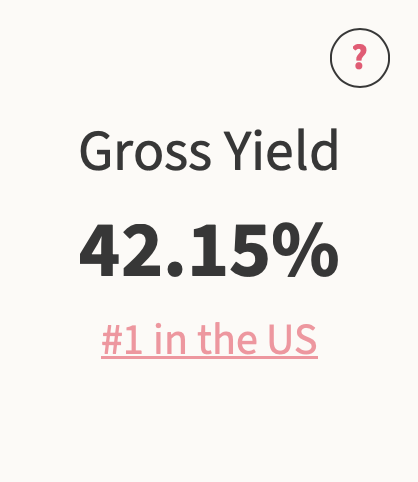

How Profitable is Airbnb in Detroit ?

AS of July 2025, the average gross yield, which represents the annual income generated by a property as a percentage of its value, is 42.15% in Detroit. This figure suggests that short-term rentals in the city offer a favorable return on investment. Detroit is ranked #1 by return on investment on Airbnb rentals in the United States.

Annual Revenue

According to Chalet, short-term rentals in Detroit earn an average of $31,969 annually, highlighting the strong investment potential in the city’s market. You can evaluate your properties using our free Airbnb calculator.

Property Tax

According to SmartAsset, the average property tax in Detroit is 1.90%. This relatively moderate tax rate is an important consideration for those looking to invest in short-term rental properties.

Regulations

Detroit’s short-term rental regulations are somewhat investor-friendly, with different zoning regulations and limitations in place. Understanding these regulations is crucial for potential investors to ensure compliance and a smooth operation.

Top Places for Airbnb in Detroit

Detroit top submarkets for Airbnb investments include areas like ZIP code 48217, which has the highest gross yield at 42% and an annual revenue of $22,601. In contrast, ZIP code 48211 offers more extensive opportunities with 23 full-time listings, but a lower gross yield of 34%.

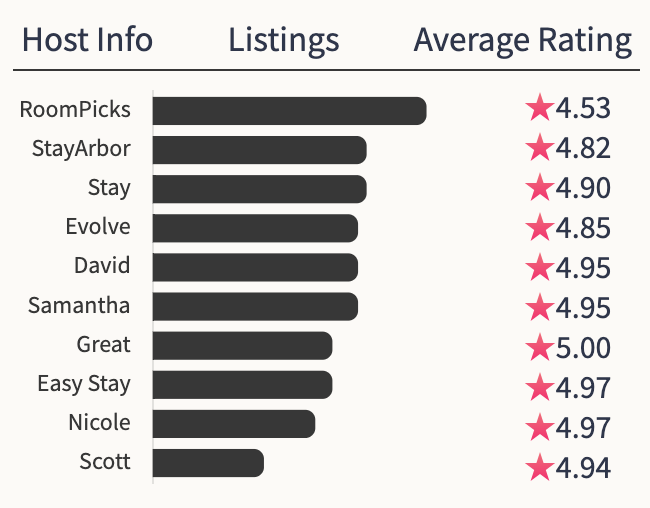

Hosts

The market is dominated by property management firms. The largest host is RoomPicks with 4.53% of the total inventory and an average review of 4.58⭐️s .

Top 100 Airbnb Rental Markets

Instantly compare the top 100 short-term (Airbnb) rental markets in the US

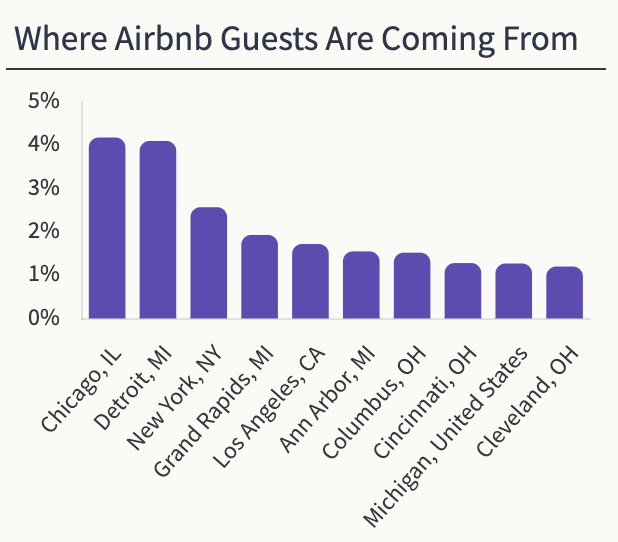

Guests

The majority of the guests come from outside of Detroit 4.18% of all guests are from Chicago followed by Detroit with 4.10%.

Detroit’s Demographic and Environmental Factors

Before diving deeper into the short-term rental market, it’s essential to understand some key aspects of Detroit:

- Median Household Income: The median household income in Detroit is an important factor to consider when targeting potential guests. As of [current year], the median household income stands at [income data].

- Climate: Detroit experiences a temperate climate with cold winters and warm summers. This climate can influence the peak season for short-term rentals.

- Population Size: Detroit’s population size is [population data], which can provide insights into the potential customer base for short-term rentals.

- Sports Teams: Detroit is home to several professional sports teams, including the Detroit Lions (NFL), Detroit Pistons (NBA), Detroit Tigers (MLB), and Detroit Red Wings (NHL). These teams attract sports enthusiasts and can be a source of demand for short-term rentals.

- Colleges: Detroit is home to [list of colleges], which can drive short-term rental demand from visiting students, parents, and faculty.

Visitor Statistics and Tourist Attractions

Understanding where visitors come from and what attractions draw them to Detroit is crucial for property investors:

- Visitor Origins: Visitor data shows that [visitor origin data] are the primary sources of tourism in Detroit.

- Total Visitors: Detroit attracts [total visitor number] visitors annually, creating a substantial market for short-term rentals.

- Tourist Attractions: Some of the most significant tourist attractions in Detroit include [list of tourist attractions]. These sites play a crucial role in driving tourism and creating demand for short-term rentals.

Peak Season and Market Opportunities

Knowing when Detroit experiences its peak tourism season can help property investors optimize their rental strategies:

- Peak Season: [Peak season information] is the time when Detroit sees a surge in tourist activity. Property owners can capitalize on this period to maximize their rental income.

Conclusion

Detroit’s short-term rental market offers unique opportunities for property investors. With affordable housing options, relatively high rental income, and a diverse range of attractions, Detroit is a promising destination for those looking to enter the Airbnb and short-term rental market. Understanding the market dynamics, local demographics, and tourist trends is key to success in this industry in the Motor City.