Miami Beach, Florida, is a vibrant and bustling coastal city known for its beautiful beaches, vibrant nightlife, and luxurious lifestyle. With its popularity as a tourist destination, the short-term rental market in Miami Beach has experienced significant growth in recent years.

In this guide, we will delve into the key statistics and trends that characterize this market and explore the factors that make it an attractive investment opportunity for Airbnb rentals.

Market Overview

To understand the dynamics of the short-term rental market in Miami Beach, let’s delve into some key statistics and figures.

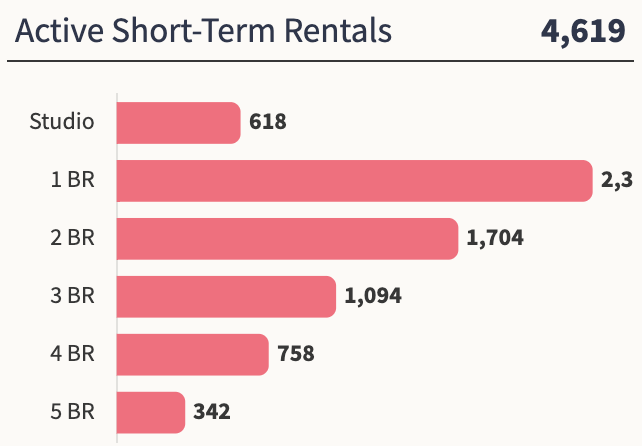

Supply

The most popular homes are 1-bedroom homes, comprising 33.04% of inventory. This is followed by 2 and 3-bedroom homes at 23.74% and 15.43% of the total inventory, respectively.

Homes Appreciation

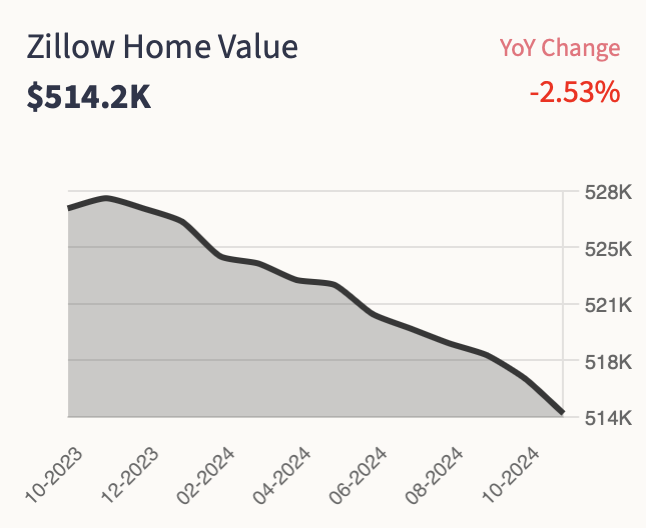

AS of July 2025, according to Zillow, homes in Miami Beach experienced an appreciation of -2.53%. This data indicates a significant increase in property values.

Median Home Value

As of January of 2025, Homes in Miami Beach have appreciated by -2.53%. The median home value in Miami Beach is $514,000 as reported by Zillow. This figure highlights the city’s robust real estate market and the potential for long-term property appreciation.

Active Short Term Rentals

AS of July 2025, Miami Beach boasts a significant Airbnb rental market, with approximately 4,619 active rentals. This abundance of available properties provides ample opportunities for investors and homeowners looking to capitalize on the tourism demand.

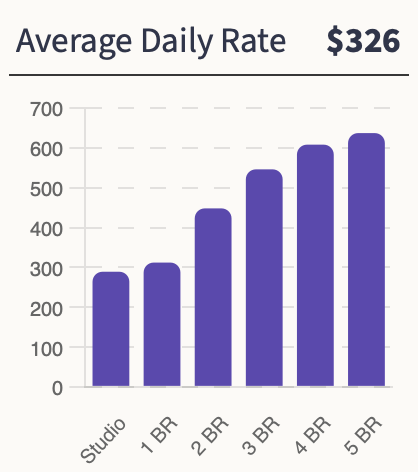

Average Daily Rate

The median ADR for the market is $326. The Average Daily Rate is the highest for 5-bedroom homes ($637) followed by 4-bedrooms and 3 bedrooms at $608 and $546 respectively.

Occupancy Rate

Chalet data reveals an occupancy rate of 56% for Airbnb rentals in Miami Beach. This high demand ensures a consistent stream of income for property owners and investors.

How Profitable is Airbnb in Miami Beach ?

AS of July 2025, the average gross yield, which represents the annual income generated by a property as a percentage of its value, is 11.11% in Miami Beach. This figure suggests that short-term rentals in the city offer a favorable return on investment. Miami Beach is ranked #51 by return on investment on Airbnb rentals in the United States.

Top Places for Airbnb in Miami Beach

Miami Beach top submarkets for Airbnb investments include areas like ZIP code 33139, which has the highest gross yield at 8% and an annual revenue of $36,690.

Annual Revenue

According to Chalet, short-term rentals in Miami Beach earn an average of $39,703 annually, highlighting the strong investment potential in the city’s market. You can evaluate your properties using our free Airbnb calculator.

Property Tax

According to SmartAsset, the average property tax in Miami Beach is 0.89%. This relatively moderate tax rate is an important consideration for those looking to invest in short-term rental properties.

Top 100 Airbnb Rental Markets

Instantly compare the top 100 short-term (Airbnb) rental markets in the US

Regulations

Miami Beach’s short-term rental regulations are somewhat investor-friendly, with different zoning regulations and limitations in place. Understanding these regulations is crucial for potential investors to ensure compliance and a smooth operation.

Hosts

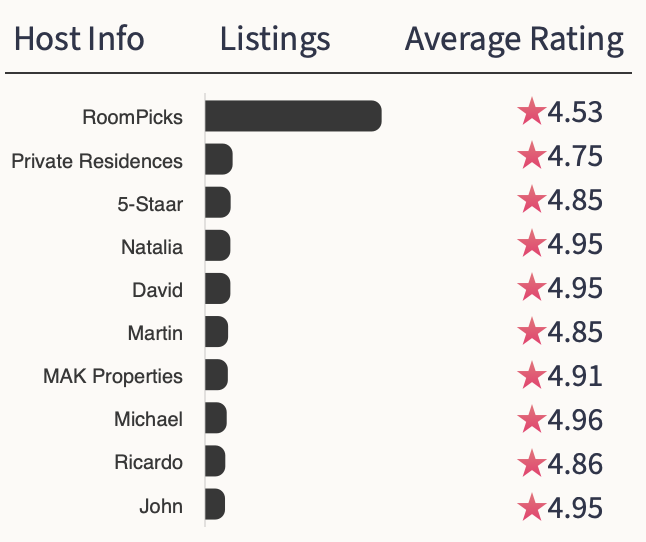

The market is not dominated by property management firms. The largest host is RoomPicks with 4.53% of the total inventory and an average review of 4.76 ⭐️s .

Property Tax and Regulation

According to SmartAsset, the average property tax rate in Miami Beach is 1.01%. This information is crucial for investors to consider, as taxes can impact the overall profitability of short-term rental investments.

Regarding short-term rental regulation, Miami Beach is somewhat investor-friendly, with different zoning regulations and limitations in place. It is essential for potential investors to familiarize themselves with the specific regulations to ensure compliance and smooth operations.

Guests

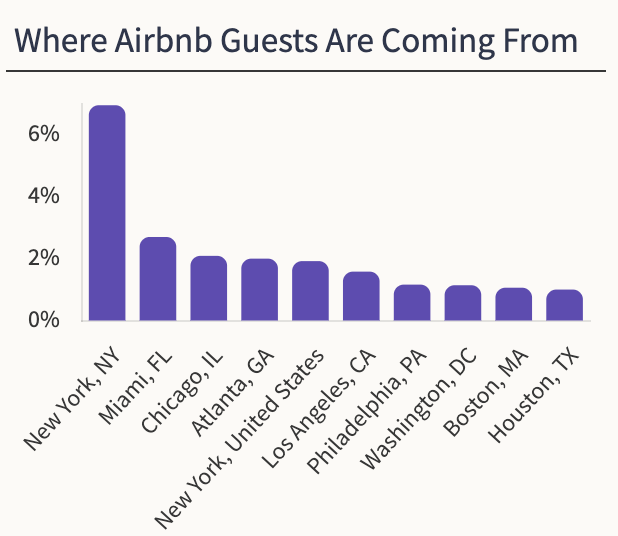

The majority of the guests come from outside of Florida. 6.93% of all guests are from New York followed by Miami with 2.80%.

Miami Beach, CA: Beyond the Short-Term Rental Market

Now that we have explored the key statistics and trends of the short-term rental market in Miami Beach, let’s delve into some additional information about the city itself.

Median Household Income

The median household income in Miami Beach, CA, is not explicitly mentioned in the provided data points. However, it is worth noting that Miami Beach is known for its affluent residents and luxurious lifestyle. The city attracts both high-income individuals and tourists seeking a taste of luxury, contributing to its vibrant economy.

Climate

Miami Beach enjoys a tropical climate, characterized by warm, humid summers and mild winters. The average temperature ranges from the mid-70s to the mid-80s Fahrenheit throughout the year, making it an appealing destination for sun-seekers and beach lovers.

Population Size

The exact population size of Miami Beach, CA, is not mentioned in the data provided. However, the city is a popular tourist destination, attracting millions of visitors each year. As we delve further into the visitor statistics, we will gain a better understanding of the city’s overall appeal.

Sports Teams

Miami Beach is home to several professional sports teams that attract avid fans and contribute to the city’s vibrant sports culture. Some notable teams include the Miami Dolphins (NFL), Miami Heat (NBA), Miami Marlins (MLB), and Florida Panthers (NHL). These teams provide exciting entertainment options for both residents and visitors alike.

Colleges

Miami Beach, CA, does not have any colleges or universities within its immediate boundaries. However, the city is located in close proximity to several esteemed educational institutions, such as the University of Miami and Florida International University, which are located in nearby areas. These institutions contribute to the city’s intellectual and cultural vibrancy.

Crime Rate

Unfortunately, the specific crime rate in Miami Beach, CA, is not provided in the data points. However, it is important for potential investors and visitors to research the current crime statistics and take necessary precautions to ensure their safety and security while in the city.

Visitor Demographics and Attractions

Miami Beach is a popular tourist destination, drawing visitors from all over the world. While the specific breakdown of visitor demographics is not mentioned in the data, the city’s vibrant culture, beautiful beaches, and thriving nightlife appeal to a diverse range of individuals.

Some of the biggest tourist attractions in Miami Beach include:

- South Beach: Renowned for its white sandy beaches, turquoise waters, and vibrant Art Deco architecture, South Beach is a must-visit destination for tourists.

- Lincoln Road Mall: A popular pedestrian street with numerous shops, restaurants, and art galleries, offering a unique shopping and dining experience.

- Art Deco Historic District: Known for its iconic pastel-colored buildings, this district showcases the best examples of Art Deco architecture in the city.

- Ocean Drive: A lively street that runs parallel to the beach, lined with restaurants, bars, and nightclubs, providing a bustling atmosphere day and night.

Peak Season

Miami Beach experiences peak tourist season during the winter months, particularly from December to April. The mild climate, coupled with the desire to escape colder regions, attracts a significant influx of visitors during this period. The peak season offers an excellent opportunity for short-term rental owners to maximize their occupancy rates and generate higher revenue.

In conclusion, the short-term rental market in Miami Beach, CA, offers an attractive investment opportunity. With a significant number of active rentals, steady occupancy rates, and a favorable average gross yield, investors can capitalize on the city’s popularity as a tourist destination.

However, it is crucial for potential investors to consider factors such as property depreciation, property taxes, and short-term rental regulations when making investment decisions. Additionally, understanding the city’s overall demographics, climate, and attractions can further inform investment strategies and enhance the rental experience for both hosts and visitors.