(Gross Yields from 10.4%, 65% Occupancy Rate)

This is the latest in our series of investor guides we release for free to our investors and everyone interested in investing in Short-Term (Airbnb) Rentals.

For this analysis, we have used the trailing twelve months (July 1st, 2021 to June 30th, 2022). See our previous post for historical data.

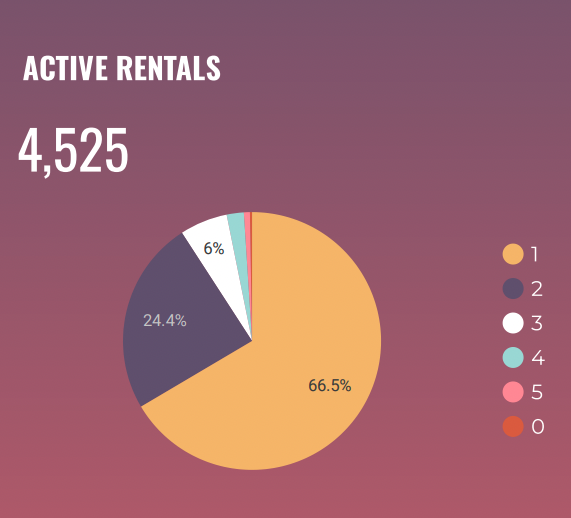

Active Rentals

There are 4,525 active rentals in Miami Beach. Almost 75% of all listings are studios and 1 bedroom.

Larger homes catering to bigger parties and families are potentially undersupplied. There are only 100 active 4 & 5-bedroom homes.

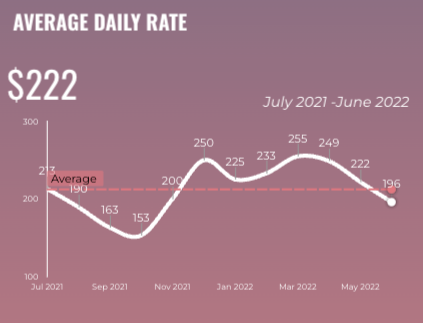

Average Daily Rate (Nightly Price)

The Average Daily Rate for rentals in Miami Beach is $199.

Throughout the year, the rate fluctuates by $69 from that average with the highest Average Daily Rate being in March 2022 ($255) and the lowest in October 2021 ($153).

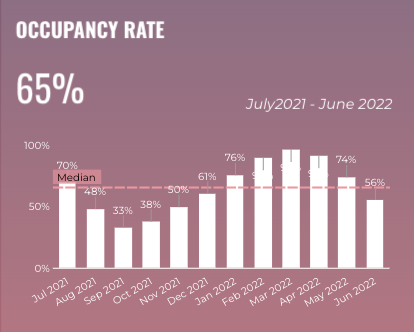

Occupancy Rate

Occupancy Rates in Miami Beach were high in the winter through this spring. The Occupancy Rate at an annual level is 65%.

The lowest occupancy rate was in September of 2021 (33%) and the highest was in March (97%).

The average occupancy rate is the highest for 2 and 3-bedroom homes, at 69% and 67% respectively.

Get projections on revenue, average daily rate, cap rates, and a lot more.

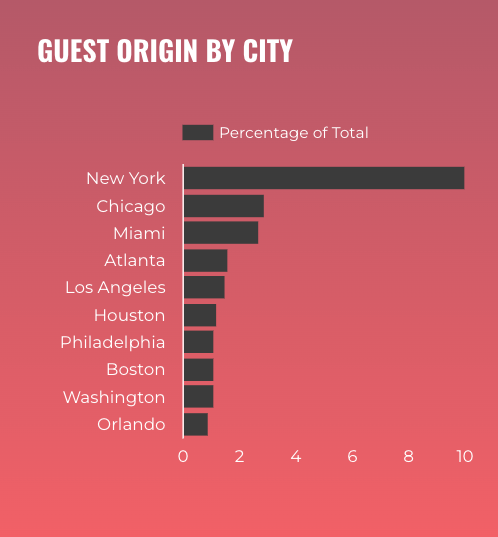

Demand

The majority of the Miami Beach short-term rental guests are domestic guests from the United States, though February is when the presence of international guests is most noticeable.

International guests in February barely cross the 28% threshold of total guests in Miami Beach. The majority of international guests visit from Argentina and Canada.

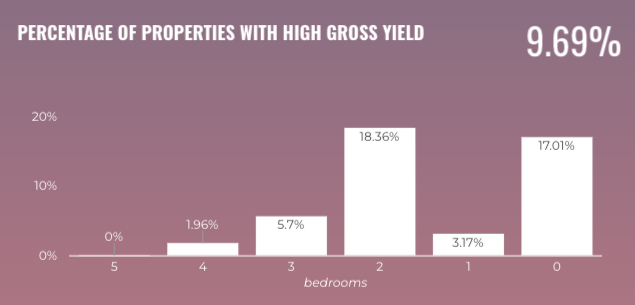

High-Performance Properties

Chalet’s research shows that 2-bedroom homes have the highest percentage of homes in the high-yield territory (18.36%) and therefore could be a good strategy for this market.

Chalet considers properties with a gross yield greater than 15% as high-yield properties. Gross yield equals Gross Income/Purchase Price

How Do I Run Airbnb Rentals Remotely?

Why pay ongoing management fees, when you can automate your Airbnb business using Chalet’s Self-Manage Services? Find out how to save thousands of dollars annually

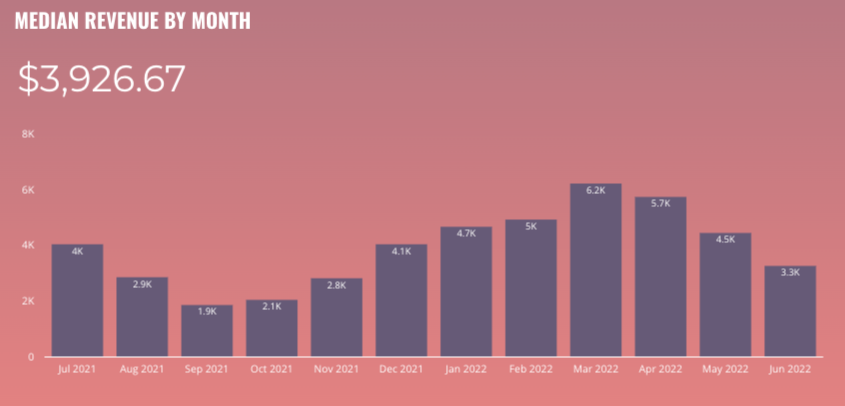

Annual Revenue

The median revenue is the highest in April of 2022 at $10900 and the lowest in June 2022 at $3300.

Short-term rentals in Miami Beach generate a median revenue of $113,221 annually. The highest median revenue for rentals in Miami Beach is for 5 bedrooms at $252,000.

Throughout the year, monthly revenue fluctuates the most for 5-bedroom homes and the least for 1-bedroom homes. More conservative investors should look into 1 bedroom investment properties as data shows they are the most stable and predictable.

Market Facts

Population – City of Miami – 454,279 / Metro – 2.717 million (2013)

- The Census Bureau ranks Miami-Fort Lauderdale-West Palm Beach, FL (MSA) as the 8th largest in the United States by population size.

- World Population Review states that Miami is currently growing at a rate of 1.08% annually. As a benchmark, FreddieMac states that US cities grow at an average 0.3%.

- Miami is ranked #128 in American for best places to live and #48 for best places to retire according to US News

Cost of Living: Payscale ranks the cost of living in Miami to be 14% higher than the national average. Miami also has 44% higher housing expenses than the national average.

Job Market: Tourism accounts for thousands of jobs in Miami-Dade County, with millions of people flying into Miami International Airport and boarding ships in PortMiami each year. Given Miami’s position as a major international port, trade and manufacturing are also key industries in the area, as is finance. Miami has been undergoing a new-construction boom in recent years, providing a number of industry-related job opportunities.

Fortune 500 Companies: Lennar, World Fuel Service, Ryder Systems

Sports Teams

- Miami Marlins – Baseball

- Miami Heat – Basketball

- Miami Dolphins – Football

- Inter Miami CF – Soccer

- Florida Panthers – Hockey

- Miami Fusion – Soccer (Fort Lauderdale)

Universities

- There are 87 institutions in Miami-Dade: 79 private colleges and 8 public colleges.

Seasonality

According to U.S.News., The best time to visit Miami is between March and May. During these months, you’ll be able to enjoy daily temperatures in the 70s for non-peak rates, while the rest of the country is still defrosting. The year-round tropical climate and partying ways of nearby Miami Beach, mean tourists – lots of tourists – from northern states, South America, Europe, Asia, anywhere and everywhere year-round. And when there are special events, the city sees even more visitors and higher hotel rates. For the best chance of scoring deals, book around the city-wide events or during the sweltering summer months.

Tourism Off-season (May – September)

- High humidity

- High temperatures

- Hurricanes season

Tourism Peak Season (January – April)

- Low to moderate temperatures

- No hurricanes

- Less humidity

- A big Spring Break crowd and many festivals

Other Facts

The average property tax rate is 1.00% which is double the state average according to SmartAsset. That’s slightly lower than the 1.07% national average.

According to Zillow, homes in Miami Beach appreciated 25.5% year-over-year (YoY) and the median home price for active listings was $2,813,000 (as of September 2022).

Homes in Miami Beach average 54 days on the market according to data from Redfin.

The BLS reported that the unemployment rate in Miami Beach fell to 2.3% in August of 2022, which is lower than the national average of 3.8%.

Short-Term Rental Regulation

Miami Beach does allow short-term rentals but only in specific zones. This is a very important consideration for investors as they should only look for properties in approved zones. Additionally, hosts must obtain the following before listing their property:

- Florida Vacation Rental Dwelling License

- City of Miami Beach Business Tax Receipt (BTR) number

- City of Miami Beach Resort Tax Certificate number

Airbnb has a great Miami regulations guide to assist new hosts with the registration process.