Hilton Head Island, South Carolina, is renowned for its pristine beaches, world-class golf courses, and family-friendly atmosphere. As a popular vacation destination, it’s no surprise that short-term rentals, especially through platforms like Airbnb, have become increasingly popular.

However, the rise of Airbnb has also brought about significant regulatory changes aimed at balancing the interests of residents, local businesses, and property owners. In this blog post, we’ll delve into the specifics of Hilton Head Island’s short-term rental regulations, providing a comprehensive guide for current and prospective Airbnb hosts.

Understanding the Regulatory Landscape

Hilton Head Island’s regulatory framework for short-term rentals is designed to ensure that the community remains a desirable place to live and visit. The town has implemented several measures to regulate Airbnb and other short-term rentals, focusing on safety, zoning, taxation, and operational guidelines.

Registration and Permitting

One of the primary requirements for operating a short-term rental on Hilton Head Island is obtaining a business license. This license is mandatory for all property owners who wish to list their homes on Airbnb. The application process typically involves providing detailed information about the property, including its location, size, and intended use. Additionally, property owners must ensure that their short-term rentals comply with local zoning laws.

Zoning Regulations

Hilton Head Island has specific zoning regulations that dictate where short-term rentals can operate. These zoning laws are crucial for maintaining the residential character of certain neighborhoods and preventing the commercialization of areas meant for long-term residents. Before listing a property on Airbnb, hosts must verify that their property is located in a zone that permits short-term rentals.

Safety and Health Standards

Safety is a top priority for Hilton Head Island’s regulatory authorities. All short-term rentals must adhere to strict safety and health standards to ensure the well-being of guests. This includes having functional smoke detectors, carbon monoxide detectors, and fire extinguishers. Additionally, properties must undergo regular inspections to confirm compliance with these safety requirements.

Occupancy Limits and Noise Regulations

To prevent overcrowding and maintain a peaceful environment for all residents, Hilton Head Island enforces occupancy limits on short-term rentals. The maximum number of guests allowed in a rental property is typically based on the number of bedrooms and the overall size of the home. Noise regulations are also in place to minimize disturbances, particularly in residential neighborhoods. Airbnb hosts are responsible for informing their guests about these rules and ensuring compliance.

Taxation

Like many other jurisdictions, Hilton Head Island requires short-term rental hosts to collect and remit accommodation taxes. This includes state and local taxes, which must be accurately reported and paid. Airbnb provides tools and resources to help hosts manage these tax obligations, but property owners need to stay informed about the latest tax rates and reporting requirements.

Enforcement and Penalties

The town of Hilton Head Island takes compliance with short-term rental regulations seriously. Non-compliance can result in significant penalties, including fines and the revocation of business licenses. The town actively monitors listings on platforms like Airbnb to ensure that all short-term rentals meet regulatory standards. Hosts found to be in violation of these regulations may face legal action and financial penalties.

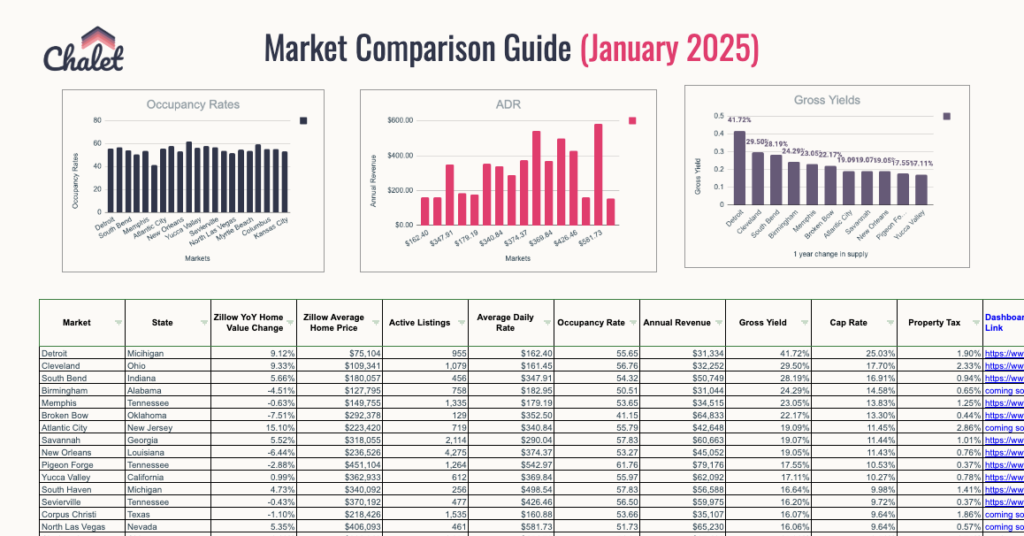

Top 100 Airbnb Rental Markets

Instantly compare top 100 short-term (Airbnb) rental markets in the US

Community Impact

Hilton Head Island’s approach to regulating short-term rentals reflects a commitment to balancing the interests of various stakeholders. By enforcing these regulations, the town aims to protect the quality of life for residents, support local businesses, and maintain the island’s appeal as a top tourist destination. Responsible hosting on platforms like Airbnb contributes to the local economy while preserving the community’s character.

Resources for Airbnb Hosts

For those considering becoming Airbnb hosts on Hilton Head Island, several resources are available to help navigate the regulatory landscape:

- Town of Hilton Head Island Official Website: The town’s website provides comprehensive information on business licenses, zoning regulations, safety standards, and tax obligations.

- Airbnb Help Center: Airbnb offers a wealth of resources and support for hosts, including guidance on local regulations, tax collection, and safety requirements.

- Local Property Management Companies: Many local property management companies specialize in short-term rentals and can assist with compliance, marketing, and guest management.

- South Carolina Department of Revenue: The state’s revenue department provides information on state taxes and filing requirements for short-term rental income.

Conclusion

Operating a short-term rental on Hilton Head Island can be a rewarding venture, but it comes with significant responsibilities. Understanding and complying with local regulations is crucial for ensuring a positive experience for both hosts and guests. By adhering to Hilton Head Island’s short-term rental rules, Airbnb hosts can contribute to the community’s well-being and enjoy the benefits of this vibrant market. Whether you’re a seasoned host or new to the world of Airbnb, staying informed and proactive about regulatory changes is key to successful and sustainable short-term rental operations.

References

This guide aims to provide a detailed overview of the regulatory landscape for short-term rentals in Hilton Head Island, SC. By following these guidelines, Airbnb hosts can ensure they are in compliance with local laws and contribute positively to the community.