Introduction

Key West, Florida, known for its vibrant culture, stunning sunsets, and historic architecture, is a prime destination for travelers seeking a unique and memorable vacation experience. As a result, the demand for short-term rentals, commonly facilitated through platforms like Airbnb, has surged. However, navigating the regulations surrounding short-term rentals in Key West can be complex. This guide aims to provide a comprehensive overview of the current regulations, ensuring that property owners and investors remain compliant while maximizing their rental income.

Understanding Key West’s Short-Term Rental Landscape

Short-term rentals (STRs) in Key West are defined as properties rented for less than 28 days. The city has implemented specific regulations to manage the impact of STRs on the local community and housing market. These regulations are designed to balance the benefits of tourism with the needs of permanent residents.

Licensing and Permitting

To legally operate an Airbnb in Key West, property owners must obtain the appropriate licenses and permits. This includes:

- Business Tax Receipt (BTR): All short-term rental operators must apply for a BTR from the City of Key West. This license must be renewed annually.

- Transient Rental License: In addition to the BTR, property owners must secure a transient rental license. This license specifically allows the property to be rented on a short-term basis.

- Vacation Rental License: For properties rented for less than 30 days, a vacation rental license is also required. This license ensures that the property meets specific safety and zoning standards.

Zoning Regulations

Key West has strict zoning laws that dictate where short-term rentals are permitted. The city is divided into various zoning districts, each with its own rules regarding STRs. Generally, STRs are more restricted in residential zones to preserve the character of neighborhoods and prevent disruptions to permanent residents. Property owners must verify that their property is located in a zone that allows short-term rentals before proceeding with licensing.

Compliance and Inspections

To maintain compliance with Key West’s short-term rental regulations, property owners must adhere to several requirements:

- Safety Standards: Properties must meet specific safety standards, including working smoke detectors, fire extinguishers, and emergency exit plans.

- Occupancy Limits: There are strict limits on the number of occupants per rental property. These limits are based on the size of the property and the number of bedrooms.

- Noise Ordinances: Key West enforces noise ordinances to ensure that STRs do not disturb the local community. Quiet hours are typically from 10 PM to 7 AM.

- Regular Inspections: Properties are subject to regular inspections to ensure compliance with all safety and zoning regulations.

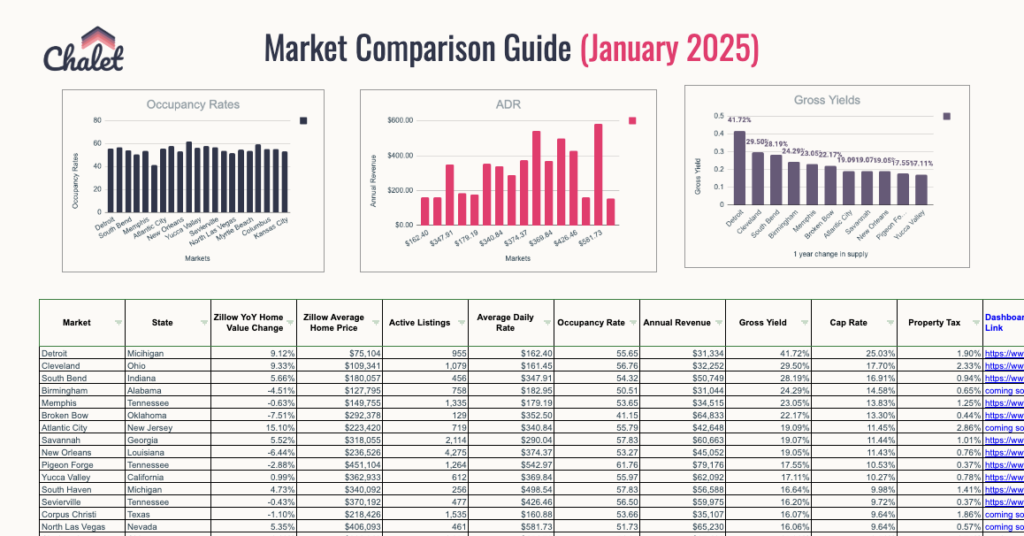

Top 100 Airbnb Rental Markets

Instantly compare top 100 short-term (Airbnb) rental markets in the US

Financial Considerations

Operating an Airbnb in Key West comes with specific financial responsibilities. Property owners must be aware of the following:

Taxes

- Sales Tax: Short-term rentals are subject to Florida’s state sales tax of 6%.

- Tourist Development Tax: Monroe County, where Key West is located, imposes a 5% tourist development tax on all short-term rentals. This tax is used to fund local tourism initiatives and infrastructure.

- Property Tax: STR operators may see an increase in property taxes due to the commercial use of their property. It is essential to budget for these additional costs.

Insurance

Standard homeowner’s insurance policies often do not cover short-term rentals. Property owners should obtain specialized insurance that covers STRs to protect against potential liabilities, including damage to the property or injuries to guests.

Resources for Key West Short-Term Rental Operators

Navigating the regulatory landscape can be challenging, but several resources are available to help property owners:

- City of Key West Official Website: The city’s official website provides detailed information on licensing, zoning, and compliance requirements for short-term rentals.

- Monroe County Tax Collector: The Monroe County Tax Collector’s website offers guidance on tax obligations for STR operators.

- Airbnb Community: The Airbnb community forums can be a valuable resource for sharing experiences and tips with other short-term rental operators in Key West.

- Local Property Management Companies: Partnering with a local property management company can help ensure compliance with all regulations and provide peace of mind.

Conclusion

Operating a short-term rental in Key West, FL, can be a lucrative venture, but it requires careful attention to the city’s regulations and compliance requirements. By obtaining the necessary licenses, adhering to zoning laws, and staying informed about local ordinances, property owners can successfully navigate the complexities of the short-term rental market. With the right approach, Airbnb hosts in Key West can provide exceptional experiences for their guests while contributing positively to the local community.

For more detailed information and to access the resources mentioned, please visit the City of Key West’s official website and the Monroe County Tax Collector’s website.